stablecoins

Money that stays steady. Stablecoins are digital tokens pegged to real assets such as the US dollar to reduce price swings. Wider digital currency adoption happens when people, businesses, and apps accept these tokens or central bank digital money for payments, savings, and new financial services at scale and faster.

They sit between fiat money and crypto. Consumers and businesses use them for faster payments and for moving value across borders. This article gives clear, practical facts. It explains how stablecoins work. It covers use cases, risks, and simple steps readers can take today.

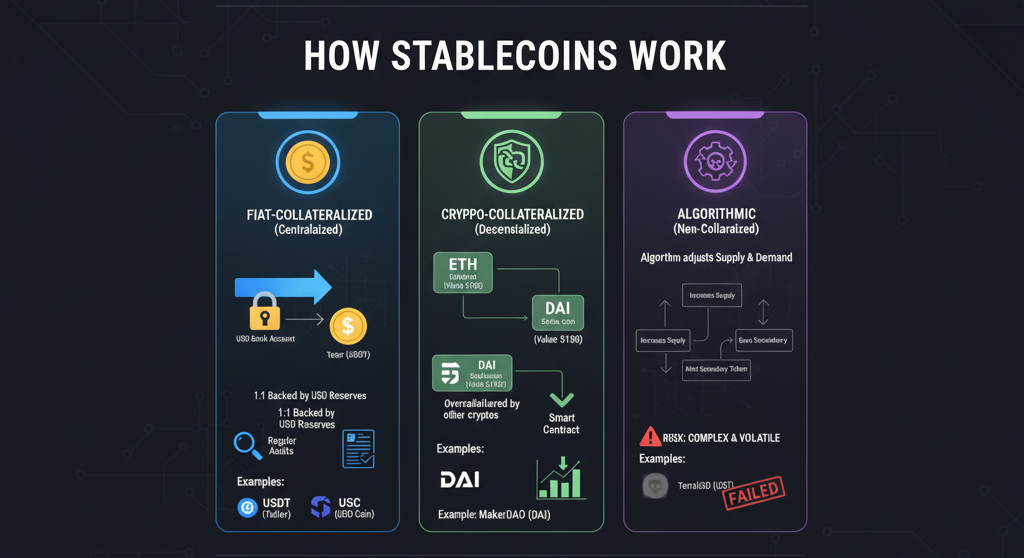

How Stablecoins Work ?

Issuers hold reserves or use program rules to maintain parity. Some use cash and short term government securities. Others use crypto collateral or algorithmic mechanisms to adjust supply. The two largest stablecoins dominate the market and move prices and liquidity across crypto exchanges. Small businesses can use stablecoins for faster supplier payments and for cross border receipts with lower settlement times. They can reduce foreign exchange steps when paired with local on ramps. Firms should test flows with limited amounts and document procedures. Work with a regulated payment partner that offers clear reconciliation and custody to reduce operational friction.

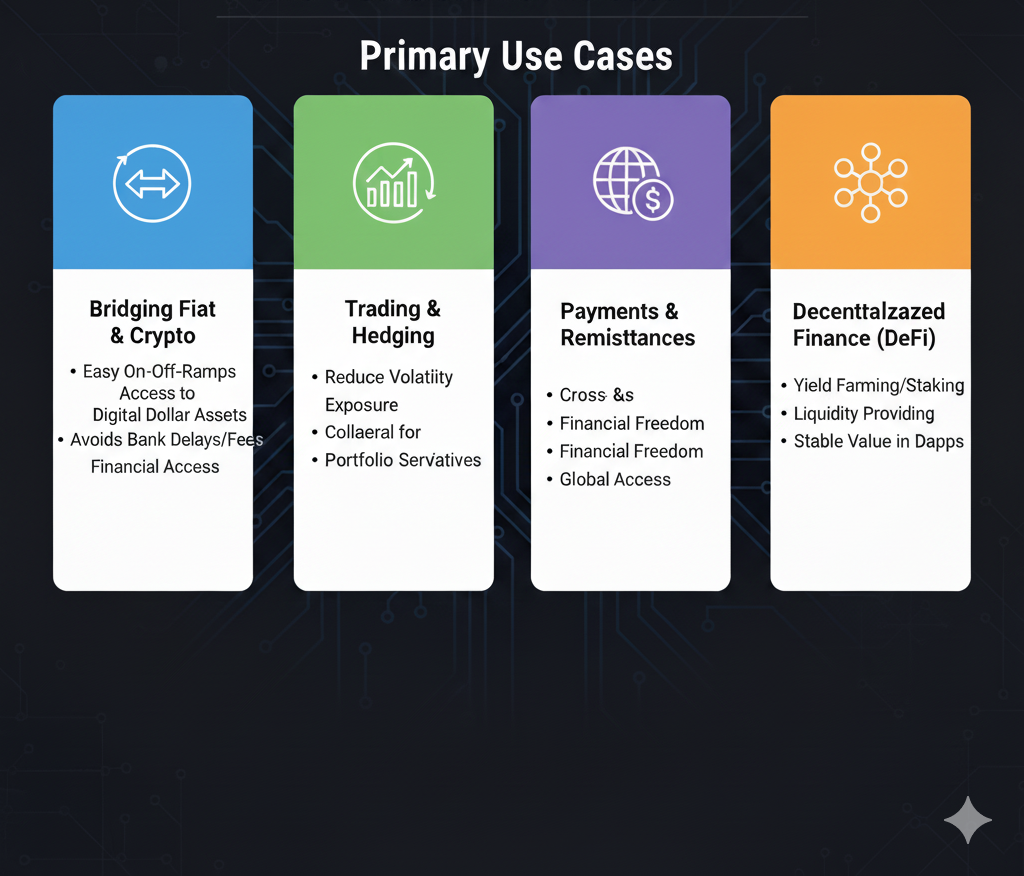

Where Stablecoins Are Used ?

Stablecoins power crypto trading and liquidity pools. They are used for cross border transfers and settlements. Merchants and payment firms test them for faster settlement and lower cost. Institutions use stablecoins for treasury use and instant settlement between partners. On chain payment corridors can reduce time and cost compared with traditional rails.

Market Snapshot

The stablecoin market has grown into the hundreds of billions of dollars in supply. A small number of issuers control most of that supply. That concentration shapes liquidity and regulatory focus. Monitor issuer disclosures and market reports before relying on a single token. Regulation varies a lot across countries. Some places move to allow regulated dollar backed stablecoins. Others tighten restrictions or propose strict custody and reserve rules.

Risks and Regulation

Reserve opacity can hide illiquid or risky assets and that can break a peg. Concentration of supply in a few issuers raises systemic concerns. Operational failures and legal uncertainty can leave users without clear remedies. Regulators and central banks have flagged these issues and are actively studying policy choices.

Regular audited reserves and custodial separation increase confidence. Regulated issuers with clear redemption procedures are easier to trust

Steps By Step Stablecoins To Be Taken

Look for regular reserve attestations from respected auditors. Test small transfers before moving large sums. Compare fees settlement windows and redemption procedures. Prefer stablecoins issued by regulated entities when you need predictable fiat access. Keep some fiat outside of stablecoins as a contingency. Track local regulatory developments that affect your ability to redeem.

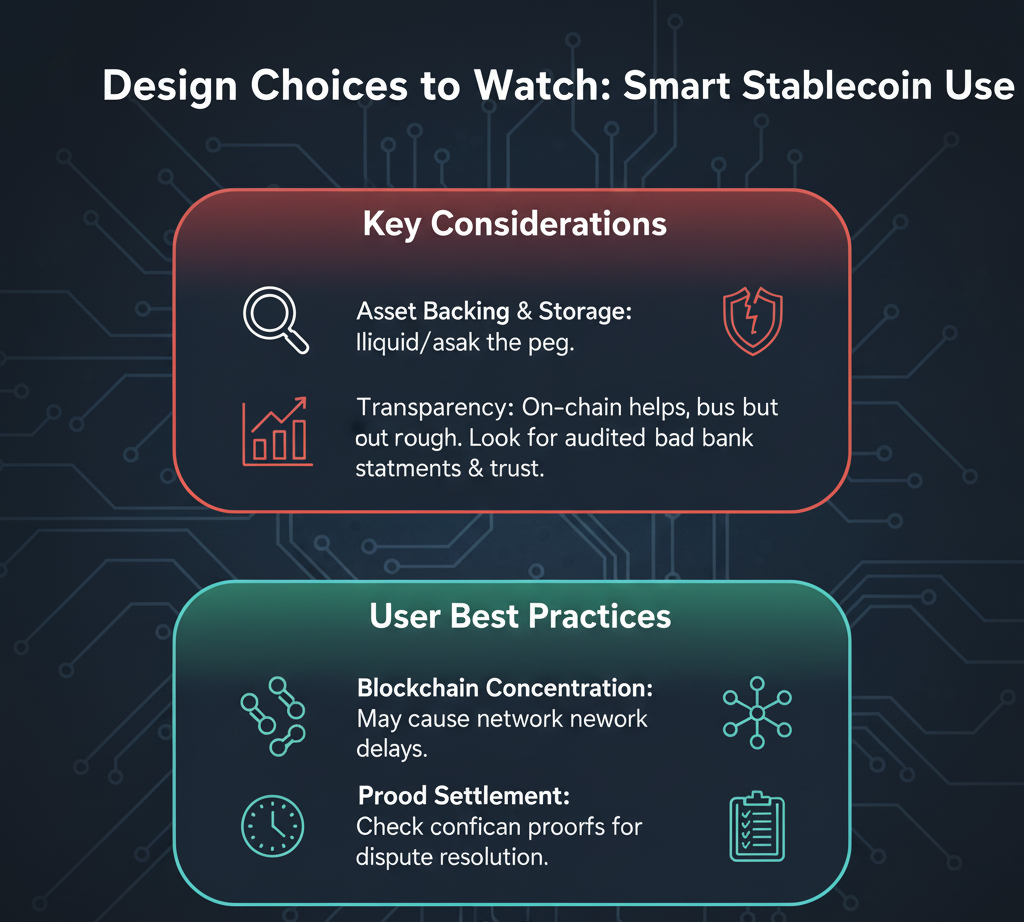

Design Choices To Watch

Study what backs the coin and how assets are stored. On chain transparency helps but is not always sufficient. Audited bank statements and custodian confirmation add confidence. Check redemption limits timing and fees. Watch whether a coin concentrates on one blockchain which may cause network related delays. Check on chain proof of settlement when possible. Keep records of confirmations and instructions for easier dispute resolution.

Where this fits in the digital currency landscape?

Stablecoins sit between decentralised finance and traditional finance. They can speed payments and enable new business flows. Central banks are exploring digital currencies and pilots are increasing. Those CBDC efforts will influence which stablecoins thrive in different regions and what legal frameworks apply. Traditional bank networks are deeply integrated into finance and enjoy legal protections and liquidity backstops that stablecoins do not uniformly provide. Stablecoins can complement rails for fast cross border payments and niche business flows. Wider replacement requires stronger regulation clearer custody frameworks and reliable fiat on and off ramps across many countries.

Conclusion

These are useful tools for faster settlement and simpler cross border flows. They are not a cure all. Use them with a short checklist. Know who issues them what backs them and how to redeem them. Watch for technical risks such as wallet loss or smart contract failures that can lock funds.

Frequently Aksed Questionms – FAQ’s

How do stablecoins keep a stable market value ?

It uses different backing methods to hold a peg. Some hold fiat in bank accounts and short dated government securities. Others lock crypto assets as collateral. A few use algorithmic reserves that expand or contract supply automatically. The design affects trust and redemptions. Check issuer disclosures and recent attestation reports before trusting the peg.

Are stablecoins safe for everyday payments and transfers ?

Safety depends on issuer and use case. For small everyday payments choose stablecoins from regulated issuers with regular reserve attestations. Use trusted wallets and exchanges for conversions. Remember operational risks exist like delays or temporary suspension of redemptions. For large balances keep funds in regulated bank accounts or insured products rather than holding large stablecoin amounts long term.

What risks should consumers watch when using stablecoins ?

Watch reserve transparency and redemption rules first. Check whether reserves are liquid and audited. Be aware of issuer concentration risk where a few players control most supply. Consider legal protections in your jurisdiction because stablecoins lack universal deposit insurance.

How central bank digital currencies affect stablecoin adoption ?

Central bank digital currencies may change demand for stablecoins. A well designed CBDC can offer a regulated digital option for retail payments. That choice could reduce reliance on private stablecoins for domestic payments. But CBDC rollout will be gradual and local. Private stablecoins may still serve cross border corridors and niche use cases for some time.

Which stablecoin checks should users perform before transacting?

Verify issuer identity and regulatory status. Look for frequent reserve attestations or audited reports. Confirm redemption mechanics and any minimums or fees. Test a small transfer end to end before scaling up.